You can now get a 30% Federal Tax Credit (not deduction) on a new Geothermal System

The Tax Credit may be claimed for spending on “Qualified Geothermal Heat Pump Property” installed in connection with a new or existing dwelling unit located in the United States and used as a residence by the taxpayer.

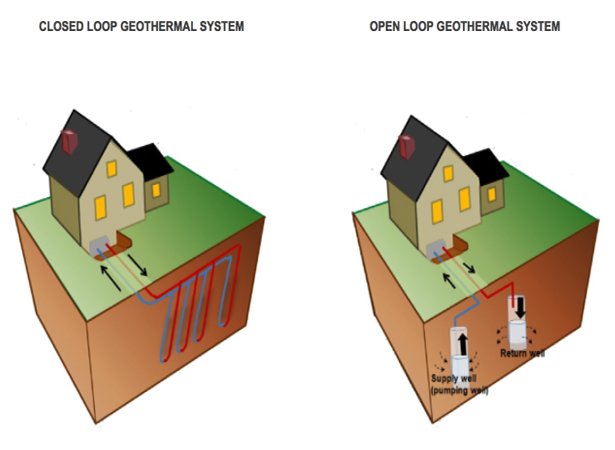

“Qualified Geothermal Heat Pump Property” means: Uses the ground or ground water as a thermal energy source to heat the dwelling unit or as a thermal energy sink to cool the dwelling unit, and meets the requirements of the Energy Star program which are in effect at the time the equipment is installed.

Labor costs associated with the installation of the geothermal heat pump property and any associated materials (piping, wiring, ducts, etc) are included. The residence does not have to be the primary residence. The tax credit can be used to offset both regular income taxes and alternative minimum taxes. If the tax credit exceeds the income tax liability, the remaining balance can be carried forward into future years.